The Main Principles Of Property By Helander Llc

The Main Principles Of Property By Helander Llc

Blog Article

The Main Principles Of Property By Helander Llc

Table of ContentsThe Property By Helander Llc DiariesSee This Report about Property By Helander LlcThe Best Strategy To Use For Property By Helander LlcHow Property By Helander Llc can Save You Time, Stress, and Money.The smart Trick of Property By Helander Llc That Nobody is Talking About9 Easy Facts About Property By Helander Llc Explained

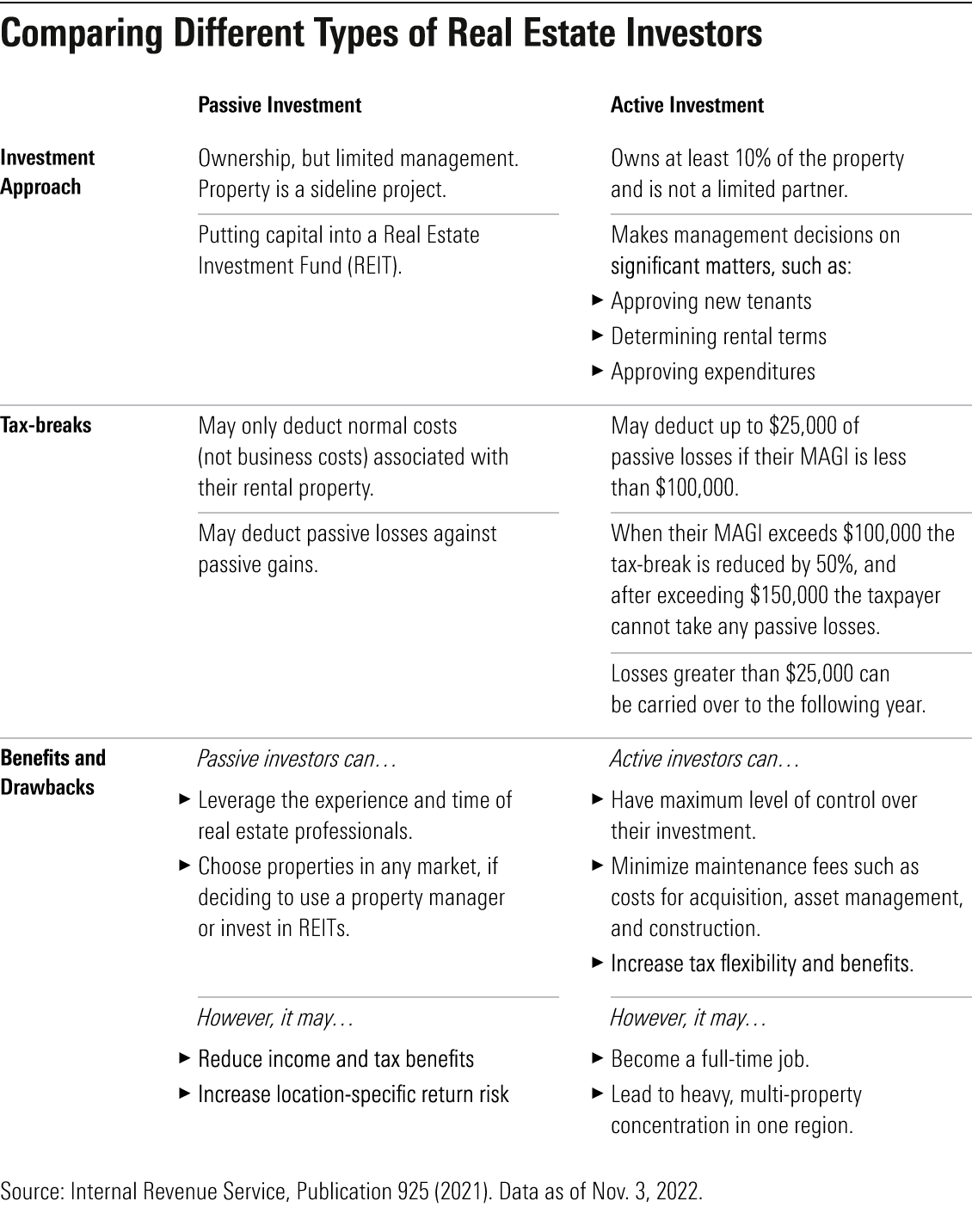

The advantages of purchasing realty are various. With well-chosen possessions, capitalists can enjoy foreseeable capital, outstanding returns, tax obligation benefits, and diversificationand it's possible to take advantage of realty to build riches. Thinking of buying realty? Right here's what you require to find out about property advantages and why property is considered a great investment.The benefits of buying realty consist of easy income, secure capital, tax advantages, diversification, and utilize. Realty investment trust funds (REITs) use a means to buy actual estate without needing to possess, operate, or finance buildings - (https://www.quora.com/profile/Frederick-Riley-28). Cash circulation is the web earnings from a property investment after home loan settlements and operating costs have actually been made.

Oftentimes, cash circulation only enhances gradually as you pay down your mortgageand accumulate your equity. Investor can make the most of many tax breaks and reductions that can save money at tax obligation time. In basic, you can subtract the practical expenses of owning, operating, and handling a home.

The 10-Minute Rule for Property By Helander Llc

Actual estate worths tend to boost over time, and with an excellent financial investment, you can turn a revenue when it's time to offer. As you pay down a property mortgage, you construct equityan property that's part of your net worth. And as you develop equity, you have the take advantage of to purchase more buildings and boost money flow and wealth even much more.

Since genuine estate is a substantial possession and one that can serve as security, financing is conveniently offered. Real estate returns differ, depending on factors such as location, asset course, and monitoring.

Not known Factual Statements About Property By Helander Llc

This, in turn, equates into higher resources values. Genuine estate often tends to preserve the buying power of funding by passing some of the inflationary stress on to renters and by including some of the inflationary pressure in the type of resources appreciation - realtors in sandpoint idaho.

Indirect realty investing includes no straight possession of a residential property or buildings. Rather, you invest in a pool along with others, where a management company has and operates residential properties, or else possesses a profile of mortgages. There are numerous manner ins which owning realty can shield against rising cost of living. Building worths might increase higher than the price of rising cost of living, leading to capital gains.

Ultimately, residential properties financed with a fixed-rate car loan will see the loved one quantity of the monthly mortgage settlements tip over time-- for example $1,000 a month as a fixed repayment will certainly come to be much less difficult as inflation wears down the acquiring power of that $1,000. Frequently, a primary residence is not taken into consideration to be a realty investment because it is utilized as one's home

An Unbiased View of Property By Helander Llc

Also with the help of a broker, it can take a couple of weeks of work just to locate the appropriate counterparty. Still, realty is an unique property class that's straightforward to comprehend and can improve the risk-and-return profile of an investor's profile. On its own, realty offers capital, tax obligation breaks, equity building, competitive risk-adjusted returns, and a hedge versus rising cost of living.

Purchasing realty can be an exceptionally fulfilling and lucrative undertaking, however if you're like a whole lot of new capitalists, you might be questioning WHY you need to be purchasing property and what advantages it brings over other investment opportunities. In enhancement to all the remarkable advantages that come along with investing in real estate, there are some drawbacks you require to consider.

Examine This Report on Property By Helander Llc

If you're looking for a means to acquire into the realty market look at this website without having to invest thousands of hundreds of dollars, have a look at our buildings. At BuyProperly, we utilize a fractional possession design that enables capitalists to begin with as low as $2500. One more significant benefit of genuine estate investing is the capacity to make a high return from purchasing, renovating, and reselling (a.k.a.

The Best Strategy To Use For Property By Helander Llc

If you are billing $2,000 rent per month and you incurred $1,500 in tax-deductible expenditures per month, you will just be paying tax on that $500 profit per month (Sandpoint Idaho real estate). That's a large difference from paying taxes on $2,000 per month. The earnings that you make on your rental unit for the year is thought about rental revenue and will be strained as necessary

Report this page